Internal real estate financing is rapidly transforming how many people are able to buy property in Mexico. In a system where bank requirements are rigid and approval times can feel endless, more and more buyers are looking for a path that is clearer, faster, and more flexible.

According to Mexico’s financial authority CONDUSEF, 4 out of 10 mortgage applications are rejected and not because buyers lack the financial capacity. Most rejections occur due to internal bank criteria, slow turnaround times, and processes that simply don’t match the needs of real buyers.

In this landscape, a new solution has become essential:

internal financing an option that allows buyers to invest without depending on a bank, without endless paperwork, and without putting their plans on hold.

In this guide, you’ll learn:

- What internal financing is (and what it isn’t)

- Why both national and international buyers prefer it

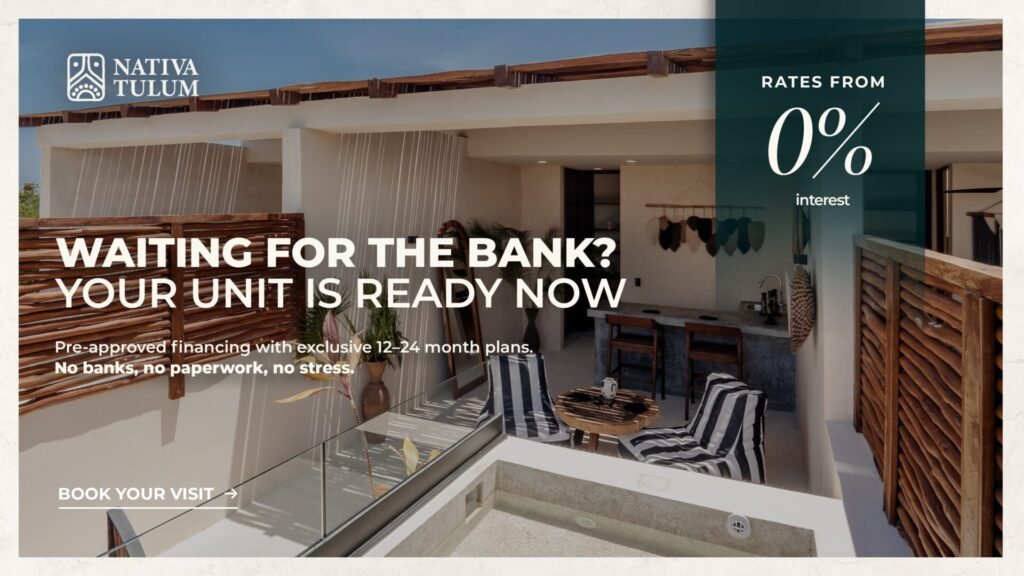

- How Nativa Tulum’s 0% plans at 12 and 24 months work

- Real scenarios where internal financing solves what banks cannot

What Is Internal Financing and Why Is It Growing So Fast?

Internal financing—also known as developer financing is a direct agreement between the buyer and the developer: no banks, no credit history requirements, and no overwhelming paperwork.

Key advantages buyers value most:

✔Faster approvals

While a bank mortgage can take weeks or months, internal financing is often approved in 48 hours or less.

✔ Fewer requirements

No credit score checks and flexible income verification.

The focus is on your intention and ability to purchase not bureaucracy.

✔ Ideal for foreign buyers

If you don’t have a credit history in Mexico, this is often the most accessible path.

✔ Clear payment structure

Fixed payments, no penalties for early payoff, and depending on the plan 0% interest.

For many, this option is not just a convenience it’s what makes their purchase possible.

How Internal Financing Works at Nativa Tulum

At Nativa Tulum, internal financing operates with a simple philosophy:

if you’re ready to move forward, we give you a way to do it today.

0% Plan – 12 and 24 Months

This plan is ideal for buyers who want:

The ability to close without waiting for bank approval

No interest

A simple, clear process

Fixed monthly payments

Immediate availability

What’s included:

Many buyers who choose this plan had everything needed to invest—except the desire to deal with the long, rigid process of a traditional mortgage.

- 0% interest

- Fast approval

- Fixed monthly installments

- No penalties for early payoff

- Access to immediate delivery units

Who Benefits Most From Internal Financing?

Buyers who want to start NOW YA

If you’re ready to invest but don’t want your liquidity trapped in a slow approval cycle, this path fits perfectly.

2. Buyers rejected by banks (for reasons unrelated to ability to pay)

Many buyers come to Nativa Tulum after being rejected once or more by banks.

The issue wasn’t their finances: it was the system.

3. International buyers

Most foreigners don’t have a Mexican credit profile. Internal financing removes that roadblock entirely.

4. Buyers who prefer short-term, interest-free plans

If you want clarity, speed, and control, internal financing outperforms traditional loans.

Real Advantages Compared to Bank Mortgages

1. Certainty from Day One

No 20-document requirements or long waiting periods just to know if you qualify.

2. A calm, transparent process

With no bank involved, communication is simple and direct.

3. Speed to secure the best units

In Tulum’s fast-moving market, the best units don’t wait.

Immediate movement gives you a real advantage.

Conclusion: Buying Without a Bank Is Not Only Possible, It’s Easier

Internal real estate financing is no longer a “secondary option”it has become one of the most practical, flexible, and accessible ways to invest in Tulum.

At Nativa Tulum, this model exists for a reason:

to give buyers a clear path forward without depending on a bank’s timeline.

If you’re looking for speed, clarity, and control over your investment process, this could be the best starting point.